Climate Change Countermeasures

Initiatives Related to the TCFD Recommendations

In April 2022, the Nidec Group announced its support for the TCFD recommendations. Through scenario analysis, we will grasp the possible financial impact of climate-related risks and opportunities and incorporate them into our management strategies. By doing so, we will further enhance our efforts to realize a carbon-free society.

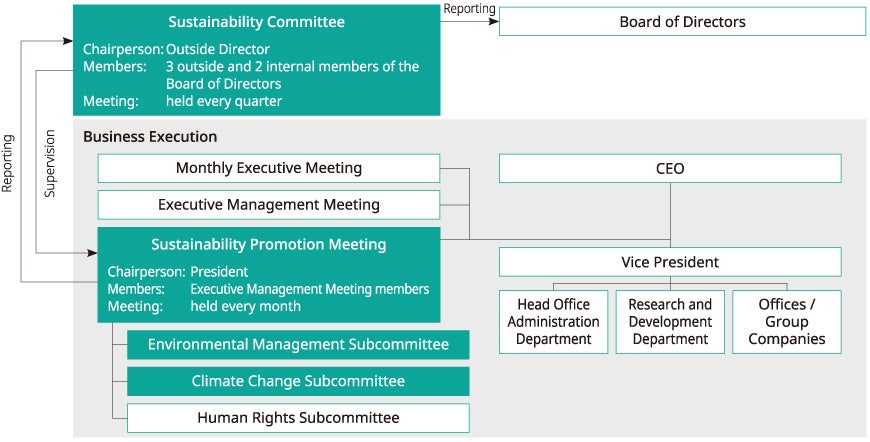

Governance

Supervisory System

The NIDEC Group supervises the execution of sustainability-related operations and reports to the Board of Directors’ Meeting at the Sustainability Committee, which is held once a quarter. This committee is chaired by an outside member of the Board of Directors and consists of two internal directors and three outside members of the Board of Directors.

Business execution system

At the NIDEC Group’s Sustainability Promotion Meeting, the status of business execution related to material issues (materiality) including the environment is confirmed, and the sustainability activity policy and important matters are deliberated and resolved. This meeting is chaired by the president and consists of members of the Executive Management Meeting. In addition, the Environmental Management Subcommittee and the Climate Change Subcommittee have been established under the Sustainability Promotion Meeting to promote environmental initiatives across the NIDEC Group.

Sustainability promotion system

Sustainability Committee agenda in FY2023

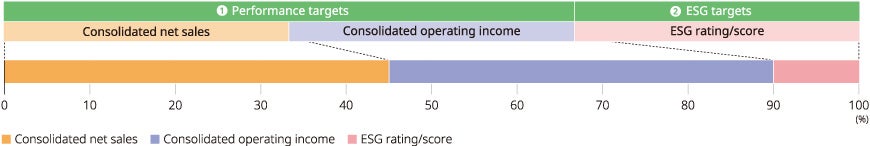

Reflecting ESG targets in performance-linked compensation for directors

From 2024, a performance-linked coefficient will be incorporated into the performance-linked share-based remuneration for directors (excluding the Founder and Chairman of the Board, outside members of the Board of Directors, and directors who are members of the Audit, etc. Committee) in accordance with the degree of achievement of performance targets in a single fiscal year, etc. The degree of achievement of ESG targets will be determined based on the ESG rating or score of the Company by MSCI, FTSE, and CDP, and will be reflected in the performance-linked coefficient.

Evaluation indicators and weights for performance-linked coefficients

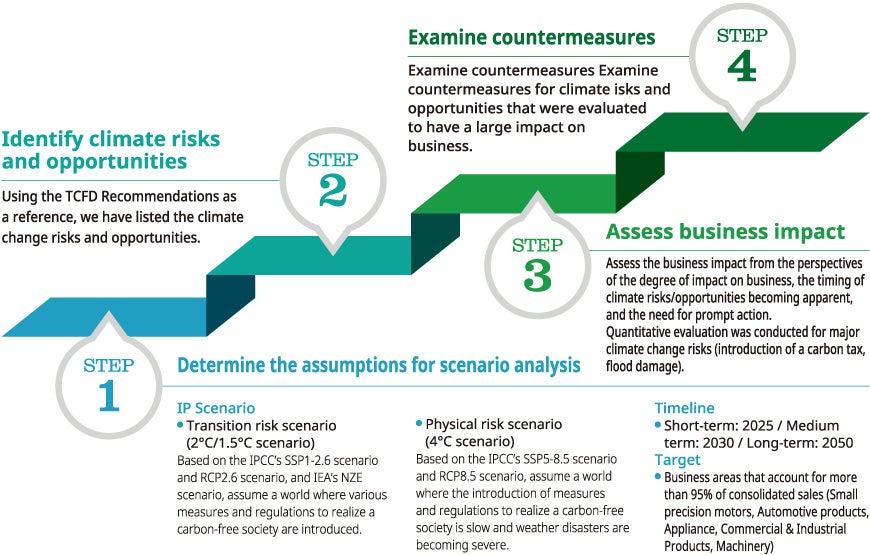

Strategy

A total of 143 executives and managers from the business areas that account for more than 95% of our consolidated sales (Small precision motors, Automotive products, Appliance, Commercial & Industrial Products, Machinery) conducted scenario analysis according to the following procedure to identify climate change risks and opportunities with a significant impact on our business, and to consider countermeasures.

The results of the scenario analysis were reported to the general managers of each business division, the Sustainability Promotion Meeting, and the Sustainability Committee.

Steps of scenario analysis

Specific examples of countermeasures

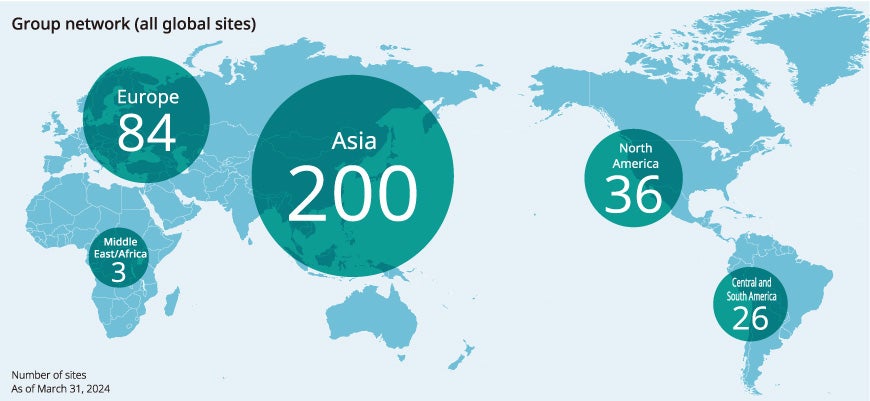

Geographical distribution of production plants

Nidec has a group network covering over 300 companies in more than 40 countries around the world and aims to reduce geopolitical risks and climate-related physical risks by geographically distributing its operation sites.

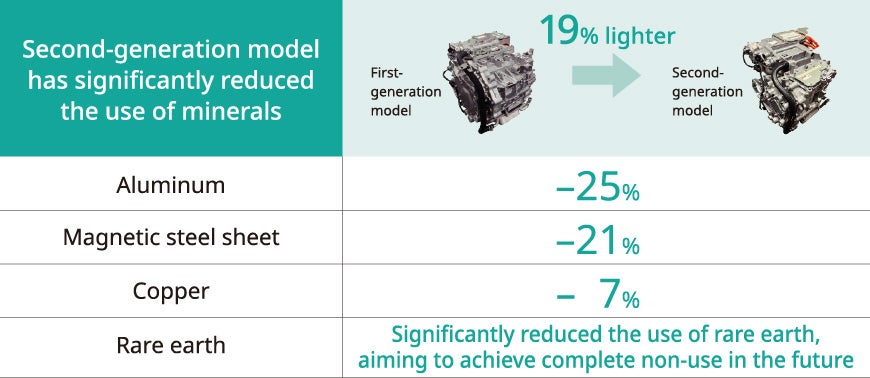

Reduction of size and weight, and resource saving by employing the “light, thin, short, and small” technology

Nidec manufactures socially and environmentally conscious products by making motors smaller and lighter and resource-saving. The first-generation model (Gen.1) of our EV traction motor system (E-Axle) achieved an overwhelming miniaturization of the motor by employing “light, thin, short, and small” technology and the oil cooling structure we had cultivated in the small precision motor business. The second generation (Gen.2) E-Axle, which began mass production in September 2022, achieved a 19% reduction in weight compared to Gen.1 thanks to the use of smaller magnetic circuits and inverters, based on the high-space-factor wire-winding technology, and also a substantial reduction in the amount of minerals used. In addition, the newly developed two-way oil-circulation system has improved the cooling capability, making it possible to use magnets that require significantly less amounts of dysprosium (Dy), terbium (Tb), and other kinds of heavy rare earth. Moving forward, we are planning to develop motors that do not use heavy rare earth or magnets.

Climate-related risks and opportunities with significant business impacts, and their countermeasures

| Impacts of climate-related risks and opportunities | Countermeasures | Small precision motors |

Automotive products |

Appliance, Commercial & Industrial Products |

Machinery | ||||

|---|---|---|---|---|---|---|---|---|---|

| SPMS | AMEC | ACIM | MOEN | NMAB | |||||

| Transition risks |

Policies and legal regulations |

Introduction of carbon taxes |

|

|

〇 | 〇 | 〇 | 〇 | |

|

|

〇 | 〇 | ||||||

|

|

〇 | 〇 | ||||||

|

|

〇 | 〇 | ||||||

| Tightening of regulations for fuel efficiency and ZEVs |

|

|

〇 | ||||||

|

|

〇 | 〇 | 〇 | |||||

|

|

〇 | 〇 | ||||||

| Introduction of regulations related to rare earths |

|

|

〇 | 〇 | |||||

| Technologies | Impact on R&D capabilities |

|

|

〇 | |||||

| Failure in investment in new technologies |

|

|

〇 | ||||||

| Transition to low-carbon technology |

|

|

〇 | ||||||

| Market | Changes in customer behavior |

|

|

〇 | 〇 | 〇 | |||

| Rise in raw material costs, difficulty in obtaining raw materials |

|

|

〇 | 〇 | |||||

| Reputation | Changes in investor evaluations |

|

|

〇 | 〇 | ||||

| Physical risks | Acute | Impact of floods, submergence, torrential rain or typhoons |

|

|

〇 | 〇 | 〇 | 〇 | |

| Chronic | Impact of droughts, water shortage, and changes in the precipitation pattern |

|

|

〇 | 〇 | ||||

| Opportunities | Products/ services |

Expansion of the market for products that contribute to decarbonization |

|

|

〇 | 〇 | 〇 | 〇 | 〇 |

| Market expansion for products that counteract temperature differences |

|

〇 | 〇 | ||||||

| Market | Expansion of EV market |

|

〇 | 〇 | 〇 | ||||

| Progress of electrification |

|

〇 | |||||||

| Entry into new markets with new products |

|

〇 | |||||||

| Resilience | Strengthening the supply chain |

|

|

〇 | |||||

Quantitative evaluation of business impact

| Risk | Financial impact | Calculation method |

|---|---|---|

| Introduction of a carbon tax | 12.4 billion yen | The carbon price is based on the IEA’s “World Energy Outlook 2022” forecast of 140 USD/t-CO₂ for developed countries in FY2030. CO₂ emissions (Scope 1 and 2) are calculated based on our 2030 target of 610,000 t-CO₂. |

| Flood damage | 42.2 billion yen | Using the “Aqueduct” water risk analysis tool provided by the World Resources Institute, we assessed the impact of a disaster affecting all 38 locations assessed as having a high risk of flooding. We calculated the impact of damage to fixed assets and inventory, as well as the opportunity loss due to the suspension of operations, using the “Guide to Assessing Physical Risks in the TCFD Recommendations” published by the Ministry of Land, Infrastructure, Transport and Tourism. |

From now on, we will work to improve the quality of our business impact assessments, and promote initiatives to effectively reduce climate change risks.

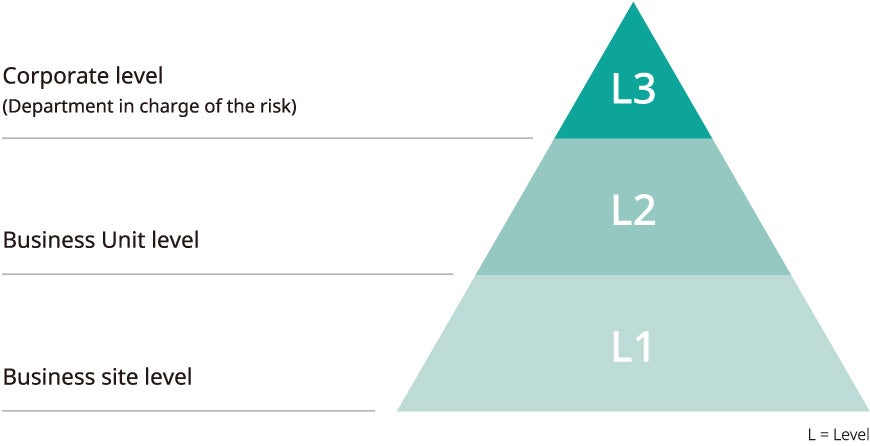

Risk management

We established a framework in which risk surveys are conducted for each of the levels illustrated below and the survey results are shared and mutually used.

With risk managers in place at each of our global locations, we are working to detect and respond appropriately to factors that could hinder business continuity. We are focusing on comprehensively understanding and mitigating climate change risks through measures that focus on compliance with increasingly strict climate change-related laws and regulations, adapting to changing market trends, and strengthening communication with customers, investors, and other stakeholders, while also conducting BCP simulation training at our bases in Japan and overseas, assuming the occurrence of risks such as floods and droughts.

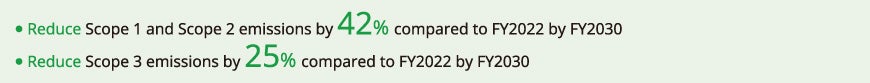

Indicators and targets

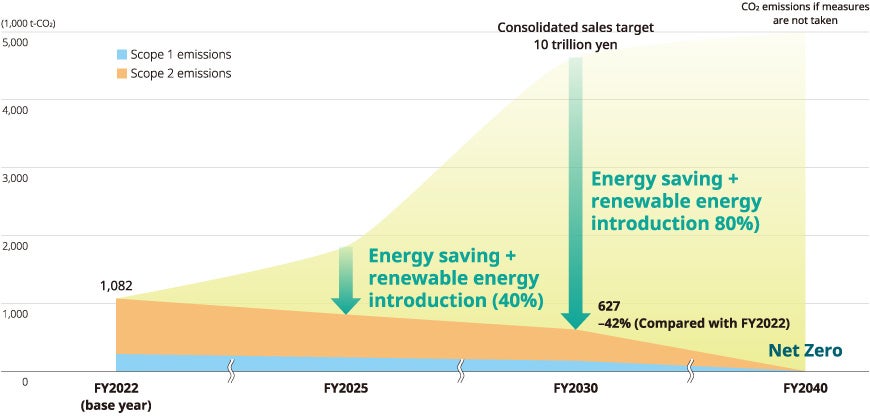

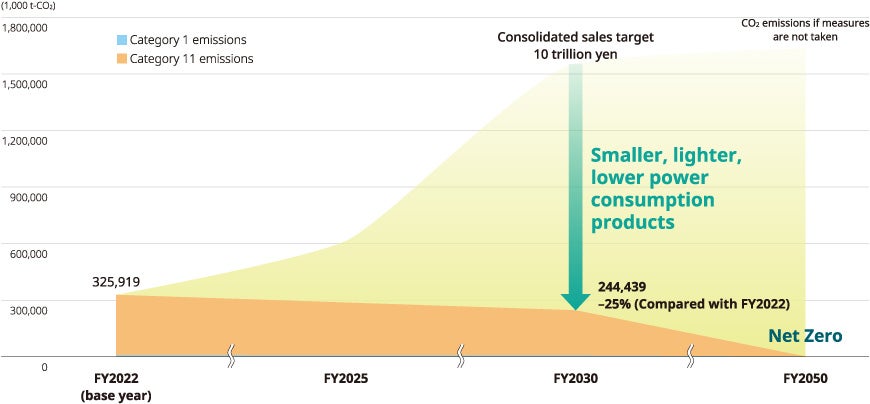

As one of the major axes of The medium-term strategic goal Vision 2025 and ESG materiality measures, the NIDEC Group aims to achieve net zero CO₂ emissions by fiscal 2040. In fiscal 2023, we underwent third-party verification of our CO₂ emissions and formulated CO₂ reduction targets for fiscal 2030 in line with the guidelines This target was recognized as a scientificallybased target for achieving the “1.5°C target” in the Paris Agreement, and we have obtained SBT certification.

Scope 1 and 2 emissions reduction targets

Scope 3 emissions reduction target

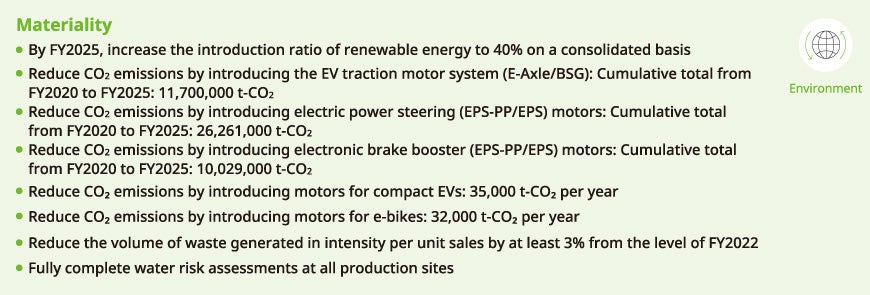

In addition, we have identified “contributing to a sustainable global environment” as one of our materiality issues, and have set the following targets.