- Contact:

- Teruaki Urago

- General Manager

- Investor Relations

- -7069

- ir@nidec.com

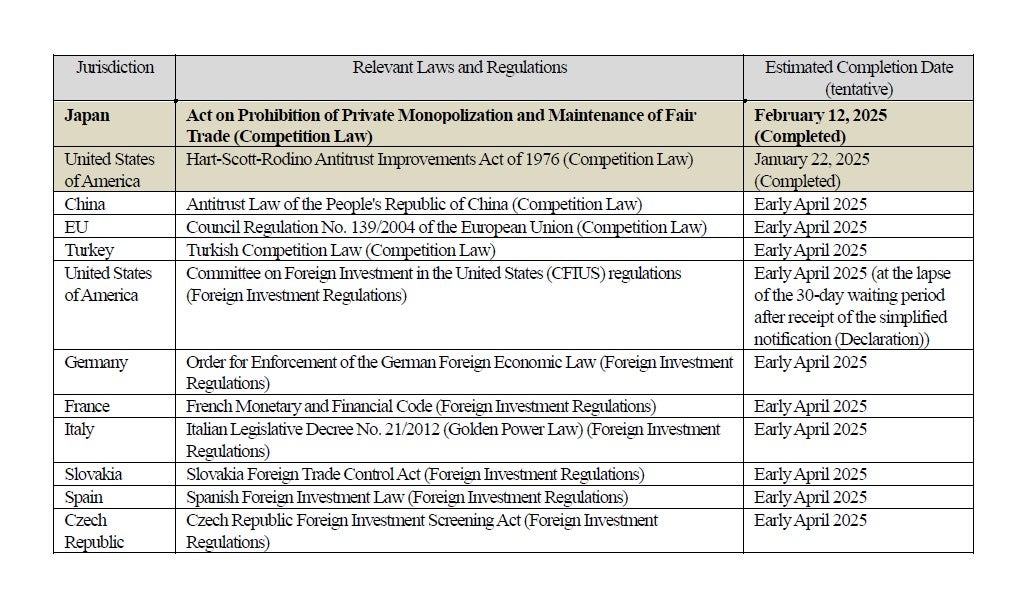

As explained in the press release, “Notice Regarding Scheduled Commencement of Tender Offer for Makino Milling Machine Co., Ltd. (Securities Code: 6135),” dated December 27, 2024, Nidec Corporation (TSE: 6594; OTC US: NJDCY) (“Nidec” or the “Company”) implemented a series of transactions (the “Transaction”) for the purpose of making Makino Milling Machine Co., Ltd. (listed on Tokyo Stock Exchange Inc.’s Prime Market) (the “Target Company”) a wholly owned subsidiary of the Company. With respect to Japan’s Act on Prohibition of Private Monopolization and Maintenance of Fair Trade (the “Competition Act”) – one of the permit applications required to be obtained in initiating the Transaction – the Company has received from Japan’s Fair Trade Commission (the “FTC”) on February 12, 2025 a notice informing that the FTC will not implement cease and desist orders, and the waiting period stipulated in Article 10-8 of the Competition Act is now shortened to the aforementioned date.

Nidec believes that the smooth completion of investigation by the FTC during the initial screening in Japan, a country home to Nidec and the Target Company, and where the two companies’ presence are highest in the world, means that anticompetitive effects to be generated as a result of the two companies’ business integration have been proved to be scarce; and also that the significance of the Transaction, i.e., Nidec’s aim to successfully become a world-leading machine tool manufacturer through integration, has been reaffirmed.

For other regions as well, Nidec will ensure to promptly disclose information regarding the completion of the proceduresregarding competition laws and foreign investment restrictionsthat the Company must abide by in executing the Transaction.